Let’s face it investing can be intimidating. A labyrinth of obstacles exist between you and all the decisions you may have to make to open a retirement account. Learning about retirement investment options include developing a basic understanding of the financial language and terminology used in this realm. As daunting as the task of learning may seem to you now, the financial knowledge and confidence you achieve will be worth it. One motivating mantra that has helped me and still propels me forward is:

No one will care more about your money than you.

This mantra has carried me through hours of searching for more simplified explanations of retirement vehicles and inquiries to payroll, investment professionals, colleagues, and anyone else who might have answers to my financial questions. As I’ve stated before in other blog posts, I’ve been contributing and maxing out my Individual Roth IRA since my late 20’s. (Every few years the IRS changes the contribution limit. As of this tax year, 2021, an individual can put in only a maximum of $6,000 with an additional $1,000 if the account holder is over 50 years of age.) My discretionary income has increased over my working years and I’ve wanted to invest in pre-tax account to diversify the types of investment vehicles I am using.

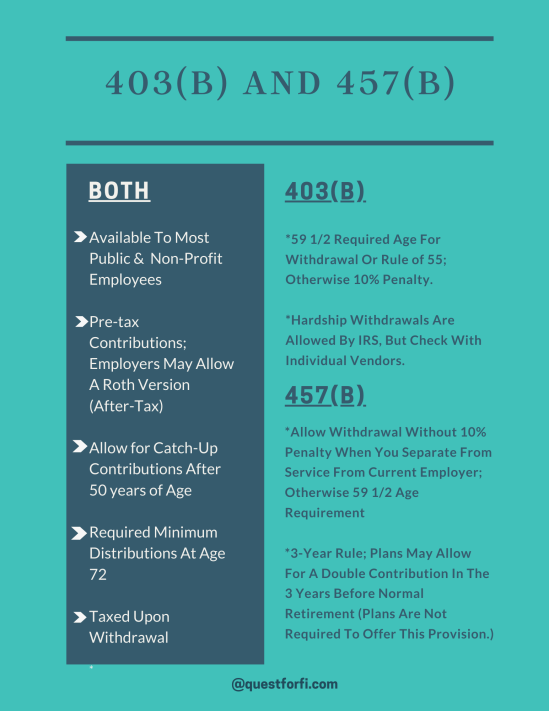

Before I share the key similarities and differences between a 457(b) and a 403(b) let me state that both the 403(b) and 457(b) can be a Roth version if your employer allows. My specific school district in Ohio does not allow a Roth option of either of these accounts. The Roth designation means that the account in post-tax, as the money goes into the account after you’ve already paid taxes on the money, and the account grows tax free. In this blog post I’m focusing on investing the money that is taken of my paycheck before tax or pre-tax, which will bring with it taxes that will be paid upon withdrawal.

Choices for Pre-Tax Investment Vehicles

As a public school teacher the 403(b) is the most common pre-tax option. You can put any amount you wish into a 403(b) from your paycheck. The contribution amount could be $50 or $100 a paycheck, but the annual limit contribution for either the 403(b) and 457(b) is $19,500 for tax year 2021. And you may elect to contribute to both the 403(b) and the 457(b) bringing the grand total of contributions up to $39,000. If one is over the age of 50 the IRS allows for an additional $6,500 pre-tax dollars to be invested (per 2021 regulations). And each vehicle has a unique catch-up provision when you get closer to retirement that may be granted by your vendor. The 403(b) has a catch-up clause for employees with at least 15 years of service. The 3-year rule may apply to some plans for the 457(b) where you can contribute twice the amount if you are close to retirement. Most government and non-profit employees have the choice of the 403(b) instead of a 401(k) that is used in the private sector. Mutual funds or annuity products can be chosen within the 403(b). However, another option most public employees and some non-profit workers also have is a 457(b). In my previous post I wrote why I was stopping my 403(b) and switching to a 457(b) and this revolved around the fact I have learned that I can contribute to the 457(b) Ohio Deferred Compensation Program that is open to ALL public employees which brings with it extensively lower fees. Lower administration fees, lower expense ratios, and no load fees or sales charge mean more money can go to work for my future self and find growth and returns.

457(b) Conditions for Withdrawals Without Penalty

An attractive aspect of the 457(b) is one can withdraw money at any age, for any reason as long as the account holder has separated from service from the original employer. If I switch school districts or retire I can access that money, penalty free, before I’m 59 ½ . This is the age the IRS has set as the time a 403(b) can be withdrawn without the 10% penalty. Of course, both the 457(b) and 403(b) money would be taxed at the individual’s normal tax rate at the time one would access it. As I continue to contemplate FIRE, Financial Independence Retire Early, having the ability to access my money when I leave full time employment would be beneficial. I would not have to rely completely on my pension or taxable accounts for living expenses. If I needed money for emergencies I would have another resource from which to pull from.

Below is a chart of similarities and differences of the 403(b) and 457(b) accounts.

Additional Links:

Investopedia 457 Plan vs. 403(b) Plan: What’s the Difference?

403bwise.org “Does the 457(b) Beat the 403(b)?” Video

Forbes 403(b) vs. 457(b): Retirement Savings For Non-Profit and Government Employees

*Disclaimer: The information provided in this blog and in this website does not and is not intended to constitute financial advice; instead all information, content, and materials presented are for general informational and educational purposes only.

Thanks for the great info!

LikeLiked by 1 person