As we turn the page to a new chapter of 2022 there’s reflection and optimism. I invested a good deal of time with a friend, LB, this past summer and early fall in helping them with a house flip that proved to be very successful in gaining experience, teamwork, and securing the possibility of workingContinue reading “Post #12 Finance Goals 2022 Part 1”

Category Archives: Uncategorized

Post #11 Is Ohio Teacher Retirement Within Reach For Me?

I have several of my friends and colleagues whom are reaching the milestone of retirement. With 25 years of service myself (24.66) I’ve become a bit envious of my friends leaving the daily grind. As I begin to eye retirement the common misconception would be that I don’t want to work. This is not theContinue reading “Post #11 Is Ohio Teacher Retirement Within Reach For Me?”

Post #10 Chasing the Apes: Shorting Stocks That May Have a Mixed Result

An Inside Look at a Nearly 70% Return With great volatility comes great risk. Many of us are risk adverse, but a certain kind of investor may take on volatility and risk if the possibility of capturing a large gain is the reward. There’s a good deal of speculation and market psychology involved in thisContinue reading “Post #10 Chasing the Apes: Shorting Stocks That May Have a Mixed Result”

Post #9 Finding Your Way Through the Maze: Explaining the 457(b) Retirement Option

Let’s face it investing can be intimidating. A labyrinth of obstacles exist between you and all the decisions you may have to make to open a retirement account. Learning about retirement investment options include developing a basic understanding of the financial language and terminology used in this realm. As daunting as the task of learningContinue reading “Post #9 Finding Your Way Through the Maze: Explaining the 457(b) Retirement Option”

Post #8 When You Know Better, You Do Better: Why I’m Stopping My 403 (b) Contributions to Switch Into a 457 (b)

I’m hard on myself. I get frustrated when I make a decision that I learn later could have been a better one. As I’ve gotten older I have grown a lot as a person and I’m better about evaluating the situation, taking what I can learn from it, and moving forward. A recent situation hasContinue reading “Post #8 When You Know Better, You Do Better: Why I’m Stopping My 403 (b) Contributions to Switch Into a 457 (b)”

#7 NGPF is an Incredible Financial Education Resource

April is Financial Literacy Month and as an educator I’m always looking for good resources to help my students and myself in this life long journey of understanding concepts within the personal finance realm. A colleague of mine mentioned there was an organization that offered free professional development and he referred me to the website.Continue reading “#7 NGPF is an Incredible Financial Education Resource”

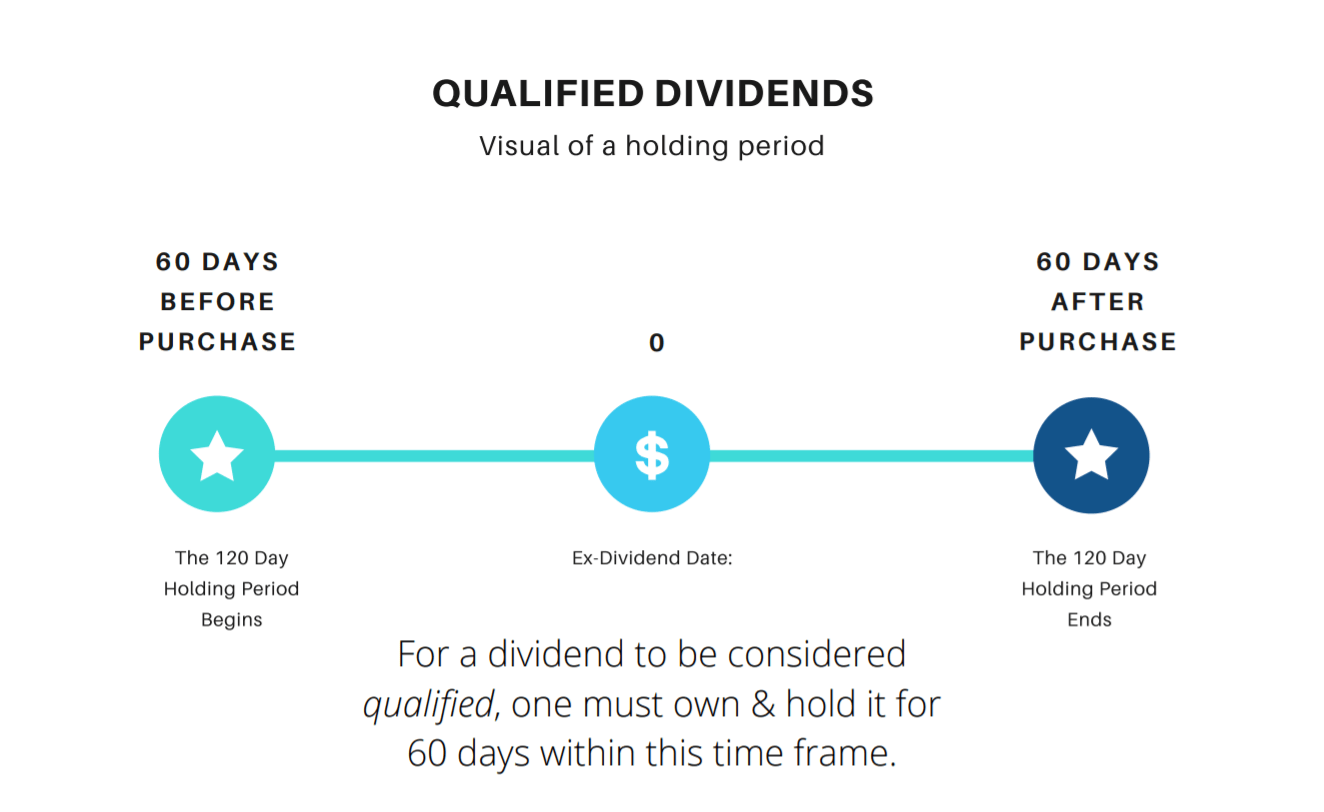

#6 What’s the Difference? Qualified vs. Ordinary Dividends

If you’re like me every time tax season rolls around you get all your paperwork in order and look through each statement from various banks, brokerage accounts, and entities and everything makes sense -until you start really looking at your forms. All those numbered and sub-numbered lines and titles seem to run together and makeContinue reading “#6 What’s the Difference? Qualified vs. Ordinary Dividends”

#5 Compound Interest: The IMPACT of TIME

The greatest tool in our toolbox as an investor is compound interest. Understanding compound interest and the impact of time in this equation is of great significance. Compound interest has been called the 8th wonder of the world and phrases like “the magic of compound interest” is used to describe this phenomena. There are severalContinue reading “#5 Compound Interest: The IMPACT of TIME”

#4 Paying a Mortgage off Early: My Pros and Cons

The largest monthly expense an individual or family has in the United States is their housing costs. I am no different. My house in the Midwest is $589 a month. This amount is only the mortgage, it does not include property taxes or insurance. If I include property taxes and insurance my housing costs increasesContinue reading “#4 Paying a Mortgage off Early: My Pros and Cons”

# 3 Saving Tips for Digital Wallet & Card Users

Several years ago businesses discovered if they could separate the consumer from their physical cash then they could possibly get the consumer to spend more money. This is why many financial experts including Dave Ramsey teach individuals to try the envelope system. This method meshes budgeting and saving together in a physical form. One usesContinue reading “# 3 Saving Tips for Digital Wallet & Card Users”