An Inside Look at a Nearly 70% Return

With great volatility comes great risk. Many of us are risk adverse, but a certain kind of investor may take on volatility and risk if the possibility of capturing a large gain is the reward. There’s a good deal of speculation and market psychology involved in this type of trading. Buying stocks of companies that have poor fundamentals; meaning companies that aren’t making a profit and do not have projections to be profitable in the near future are usually not advised. However, there is a movement that began in the popular Reddit forum Wall St. Bets that encourages retail investors, individual investors like you and I, to buy stocks of these unprofitable companies and hold.

Jargon and creative vocabulary terms have been developed around this type of investing in various discussion groups and forums. Here are a few words that may be advantageous at this juncture to introduce so you may better understand the movement and motives behind purchasing stock of struggling companies. Retail investors who buy and hold a position to push up a price on a struggling stock are referred to as Apes on investment forums. Diamond Hands vs. Paper Hands are terms that give meaning to how strong an investor is on holding their position. Having Diamond Hands signifies a person will hold their stocks no matter what and the individual truly believes in the price of the stock moving upward and in the particular cause of that purchasing event. In contrast, having Paper Hands is considered a slam and denotes an investor may sell their stock at the first sign of a downward trend. Investopedia has a more complete list on their website of WallStreetBets Slang and Memes.

These types of movements where retail investors are encouraged to buy particular stocks is two-fold. Obviously, a motive is hoping to make a significant individual return, but the second intention is to also to apply pressure on large institutional hedge fund companies to buy more of a particular stock to drive the prices even higher and perhaps make the hedge funds lose money. In some people’s eyes this type of trading is pitting the Underdog against Big Money. (This type of trading may not be wise if you consider many hedge funds make up portions of average American’s 401K’s and pension investments. And a manipulation of their practice may not be beneficial to most Americans if they have investment in these particular vehicles.)

Think GameStop

In January 2021 a large retail investor group on Reddit’s forum urged people to come together and buy large positions in GameStop to run up the price of a failing company. If you’re not familiar with GameStop it has been compared to the Blockbuster of the videogaming industry. GameStop is compiled of physical stores which allows you to walk into a building and purchase a physical copy of a videogame on a disc for various game consoles like PlayStation and Xbox. This now seems to be an ancient practice, and hence the reason GameStop’s business had been plummeting. I like Milton Ezrati’s simplified explanation of the GameStop event from his article, The GameStop Stock Saga: A Postmortem, from Forbes website:

“There was a group of people who for obscure reasons wanted to buy large quantities of a small stock. There was a group of people who thought that the buying was misplaced. They bet against each other. Some won and some lost. Millions were entertained. There is no good or bad involved, unless stupidly taking excessive risk is somehow immoral.”

One Short-Term Trade Experience

I’ll admit sometimes long-term investing tries my patience. Yes, I’ve seen large gains over the last two and half decades with my own money management made up of mostly mutual and index funds. And, yes, the amount of money I’ve contributed to my ROTH accounts have now been eclipsed by the amount of unrealized gains. I should be satisfied, right? But I’m human. I read stories of people becoming over-night millionaires with cryptocurrency or speculative stocks and those isolated events peak my interest. After watching several YouTube videos and reading a handful of articles that highlighted that premise of high reward in a short time frame I decided to explore the world of the Apes.

Day #1

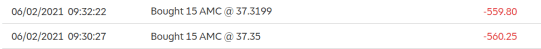

I chose to put under $1,200 into AMC Entertainment Holdings, Inc. ($1,120.05 to be exact.) AMC Entertainment Holdings, Inc. include several theatres and cinemas in the United States. Obviously, the pandemic has created a large disruption to their business and they’ve been on the verge of bankruptcy for some time. The initial investment allowed me to purchase 30 shares of this struggling company.

As I watched the price of the stock climb throughout the day, I thought I had made a good decision. I had been tempted to sell, but after perusing posts on a couple platforms decided “the movement” had momentum. I’d wait and see how this played out. Afterall, GameStop made it all the way past $400 a share on a closing day this past winter and up to $500 in intraday trading on January 27, 2021.

Day #2

AMC announced a few hours before the market opened that the company would be releasing over 11 million new shares. This move was a good business decision by AMC. It allowed the company to raise more revenue, but it also inflated the market and the price of the stock started declining quickly. All of the unrealized returns I had made the day before was evaporating before my eyes.

Mid-day the price of AMC stock pushed higher and at that point I decided I had Paper Hands rather than Diamond Hands.

All said and done in my less than 36 hour experience I had realized gains of $772.94. I had bought my 30 shares of AMC with an average of $37.34 and I had sold with a cost of $63.09 a 69%, nearly 70% return on my initial speculative investment.

Through this experience I have learned that most brokerages have specific rules on pattern day trading which allows a regular trader to only trade within a 24 hour period four times in five business days unless the person has a day trading account. Also, funds used for buying and selling a stock short term must be settled or a free-riding violation may incur. Cash is usually considered settled after a three-day period of transfer from your bank or institution to your brokerage.

Personal Take Away

While it is tempting and in many ways exhilarating to partake in this kind of short-term trading, I’m afraid the risk may not be worth it to me to trade in this manner often. I’m happy my adventure turned out profitable, but my stomach churned as I watched the market swing wildly up and down during the trading hours and found so much relief when I finally hit the button to sell my shares. I have to hand it to the Apes that have Diamond Hands. The Apes truly are a rare breed of retail investors that withstand great volatility in search of great returns. And let’s face it sometimes those great returns are elusive.

~Quiet Turtle

*Disclaimer: The information provided in this blog and in this website does not and is not intended to constitute financial advice; instead all information, content, and materials presented are for general informational and educational purposes only.

Good for you for taking a risk. I never have. 🙂

LikeLike