Several years ago businesses discovered if they could separate the consumer from their physical cash then they could possibly get the consumer to spend more money. This is why many financial experts including Dave Ramsey teach individuals to try the envelope system. This method meshes budgeting and saving together in a physical form. One uses actual envelopes and places a certain dollar amount in each envelope set aside for specific purposes like gasoline, groceries, and so on.

However, today America is moving closer to a cashless society. This lends itself to an entire blog all it’s own where the pros, cons, and steps to a cashless society will be explored. More on that in the weeks to come. Being cashless and performing transactions on debit or credit cards is becoming very common place for most Americans. Throw in the pandemic and people are simply more comfortable with this convenient way of purchasing items. So, how is a person to save if they don’t physically touch their cash?

*Automate Savings

*Keep a Visual on Your Savings

*Watch for Fees on Transactions

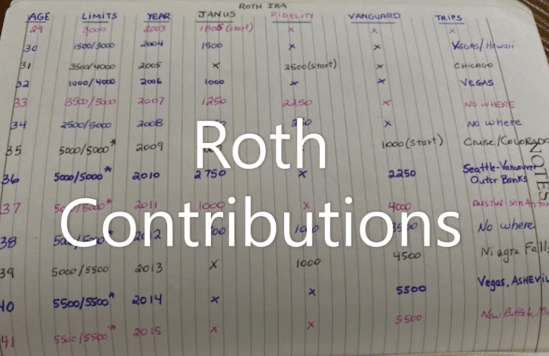

Automate your Savings is one of the most common suggestions one will hear when it comes to saving money in general. If you’re using digital wallets, credit or debit cards you have a different kind of control over your money. Whether it be for an emergency fund, a specific purchase, or retirement there’s no simpler way to save, but to have a recurring amount of money being pulled from your checking account to go into a separate savings vehicle. This savings vehicle could be a savings account, ROTH IRA, or an employer sponsored account like a 401 (k), 403 (b), 457(b) or similar items. Paying yourself first is a popular tactic. Knowing that you’re saving an amount of your income may help you control your purchases.

Keep a visual on your savings. I believe tracking expenses and the amount that you are saving in a visual way helps immensely. There are numerous ways to do this visually. One way is to merely check your accounts weekly or bi-weekly and be mindful of your savings. Seeing the balance grow week after week becomes a very encouraging motivator.

A spreadsheet in either Microsoft excel or Google sheets could be helpful as well. Along with other tactics to create visual reminders, a more hands-on approach may include creating a bullet journal for a visual savings. Keeping your eyes on the prize is going to help most people.

I admit, I’m a little old school and I still enjoy going to my local bank and paying off my mortgage. For me there’s something about writing a check and handing it to the bank, and in return getting a computer printed balance slip.I place that on my refrigerator and every time I open or close my refrigerator I see that slip of paper reminding me how far I’ve come and how much more I have to go.

For those that are not as old school as I, there are certainly an array of different fintech tools as app one can download to your smartphone. Check out App Annie to see the different kinds of fintech tools that exist and see if any of them could benefit you. I’ve heard good reviews on Mint, one such app that is currently ranked in the top 25 financial apps, but I’ve never personally used this app myself.

Watch for fees on transactions. When one pays with digital wallets, credit cards, or debit cards many times businesses add a transaction fee. Here’s a personal example of a transaction fee. While looking at my property taxes this month I noticed my County Treasurer site had an additional 2.5% fee if one paid with a credit card. My property taxes are $1,949 for a half-year for my half-acre property. The additional 2.5% transaction fee was $48.73. While cashless payments certainly have their advantages processing those payments sometimes come with a cost. I’m writing the check this year and mailing my property taxes.

Good luck with saving! Stay positive and any bit saved you’re better off than you were the day before.

~Quiet Turtle